FairLabs Team

Jun 24, 2024

Weekly ESG Controversies (June 17~23)

Key takeaways

Ongoing 'Competitive Behavior' Controversy:

The 'Competitive Behavior' risk surged from 15.24% to 22.84%, becoming the top issue.

Significant contributors:

HYBE and Min Hee-jin management dispute (17.09%)

Samsung Electronics patent lawsuits (13.94%)

SPC Samlip and SK issues (11.30% and 10.10%, respectively).

Illegal Rebate by Koryo Pharmaceutical:

Dominates 'Customer Welfare' and 'Business Ethics' categories.

Evidence shows illegal rebates to over 1000 doctors, indicating systemic issues.

Continuous Controversy Over Ssangbangwool's Alleged Payments to North Korea:

Persistent 'Business Ethics' risk due to allegations of payments to North Korea.

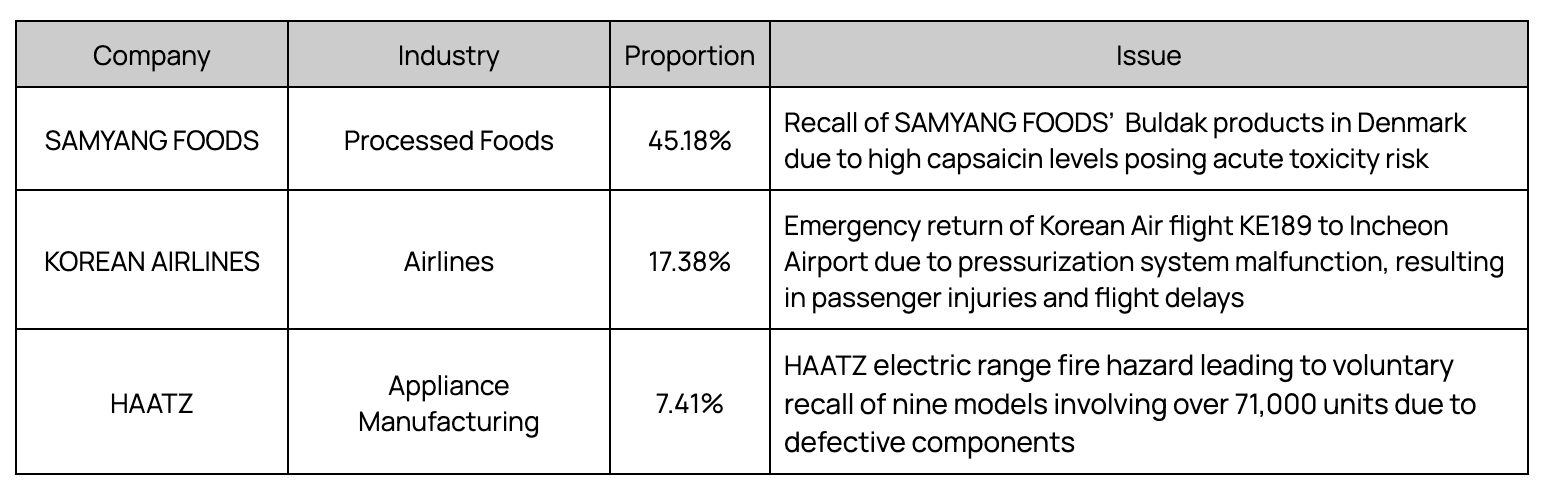

'Product Quality and Safety' Controversies Beyond the Automobile Industry:

Recalls by SAMYANG FOODS and HAATZ.

Korean Air emergency return due to mechanical defects, resulting in injuries.

Increasing 'Data Security' Risk:

Naver's data security issues resurface; LINE Yahoo pushes for system separation.

Samsung Electronics researcher convicted of leaking semiconductor technology.

Competitive Behavior (22.84%)

HYBE and ADOR Dispute: Management rights conflict with Min Hee-jin resurfaces.

Samsung Electronics Information Breach: Ex-patent executive arrested for leaking confidential information.

Customer Welfare (12.61%)

Illegal Rebates by Koryo Pharmaceutical: The illegal rebate scandal involving KOREAN DRUG accounts for 45.95% of the total cases, highlighting structural issues within the pharmaceutical industry and suggesting the possibility of expanded investigations.

SAMYANG FOODS’ Excessive Capsaicin Content: The controversy over the excessive capsaicin content in SAMYANG FOODS’ products continues from last week, raising ongoing concerns about consumer safety.

Business Ethics (11.27%)

Illegal Rebates by Koryo Pharmaceutical: Following its prominence in 'Customer Welfare,' the illegal rebate scandal involving KOREAN DRUG also holds the largest share in 'Business Ethics' at 22.15%.

SBW and PAIKKWANG INDUSTRIAL : Both Ssangbangwool and PAIKKWANG INDUSTRIAL are continuously embroiled in their respective ongoing controversies, while KT is facing multiple complex controversies simultaneously.

Product Quality & Safety (6.55%)

Recalls by SAMYANG FOODS and HAATZ: Both SAMYANG FOODS and HAATZ have initiated recalls for their respective problematic products.

KOREAN AIRLINES Emergency Landing: KOREAN AIR LINES conducted an emergency landing due to an aircraft defect, during which 18 passengers were injured and 13 were transported to the hospital.

Data Security (5.89%)

LINE Yahoo System Separation from Naver: The issue of LINE Yahoo pushing to separate their systems from Naver has resurfaced, capturing 61.38% of the attention.

Samsung Electronics Semiconductor Technology Leak: An incident involving the leakage of core semiconductor technology at Samsung Electronics has occurred.

KT PC Malware Hacking Allegations: KT remains embroiled in continuous controversy over allegations of PC malware hacking in 2020.

This week's observations on ESG risks vividly illustrate the vast and intricate array of dangers that industries and individual companies might encounter. For instance, the protracted litigation faced by Medytox over a specific issue and the unforeseen new risks like political entanglement allegations against SK Group showcase both the enduring and the emerging challenges in today's business landscape. Furthermore, recent concerns around ‘personal information protection’ and ‘data security’ transitioning into broader ‘systematic risk management’ issues highlight how certain risks can evolve into others, suggesting a complex interplay of risk factors.

In response, it is crucial for companies not only to swiftly address and mitigate long-standing risks but also to continuously monitor for newly arising or transitioning risks to effectively reduce their exposure. This proactive and comprehensive approach to risk management is essential for maintaining stakeholder trust and ensuring sustainable business operations in an increasingly unpredictable and interconnected world.

Disclaimer: This content was made with the help of AI. It may contain errors or inaccuracies, and should not be relied upon as a substitute for professional advice. The information contained in this article is not investment advice. FairLabs does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

All rights reserved. © FairLabs 2024

Latest Posts